Looking Good Tips About How To Buy Calls And Puts

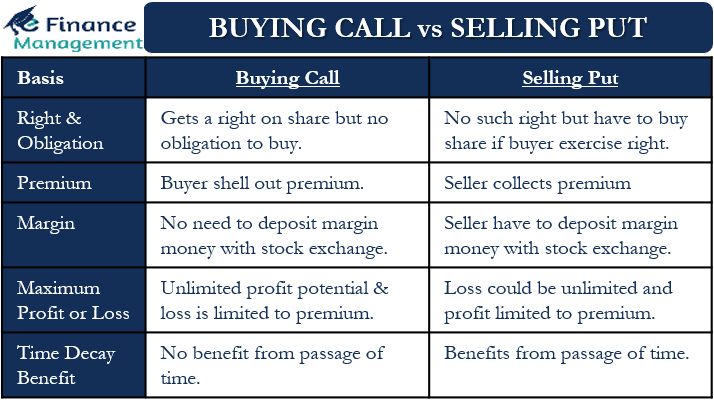

But the investor doesn’t have to pay the market margin money before the purchase.

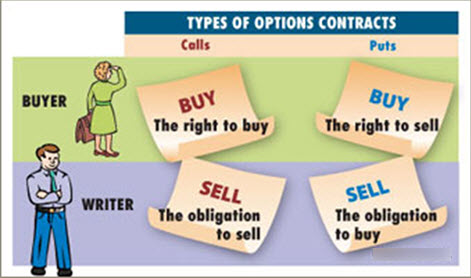

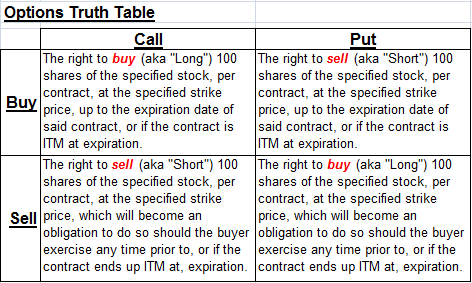

How to buy calls and puts. Ad trade with the options platform awarded for 7 consecutive years. Ad trade with the options platform awarded for 7 consecutive years. Buying a call option entitles the buyer of the option the right to purchase the underlying futures contract at the strike price any time before the contract expires.

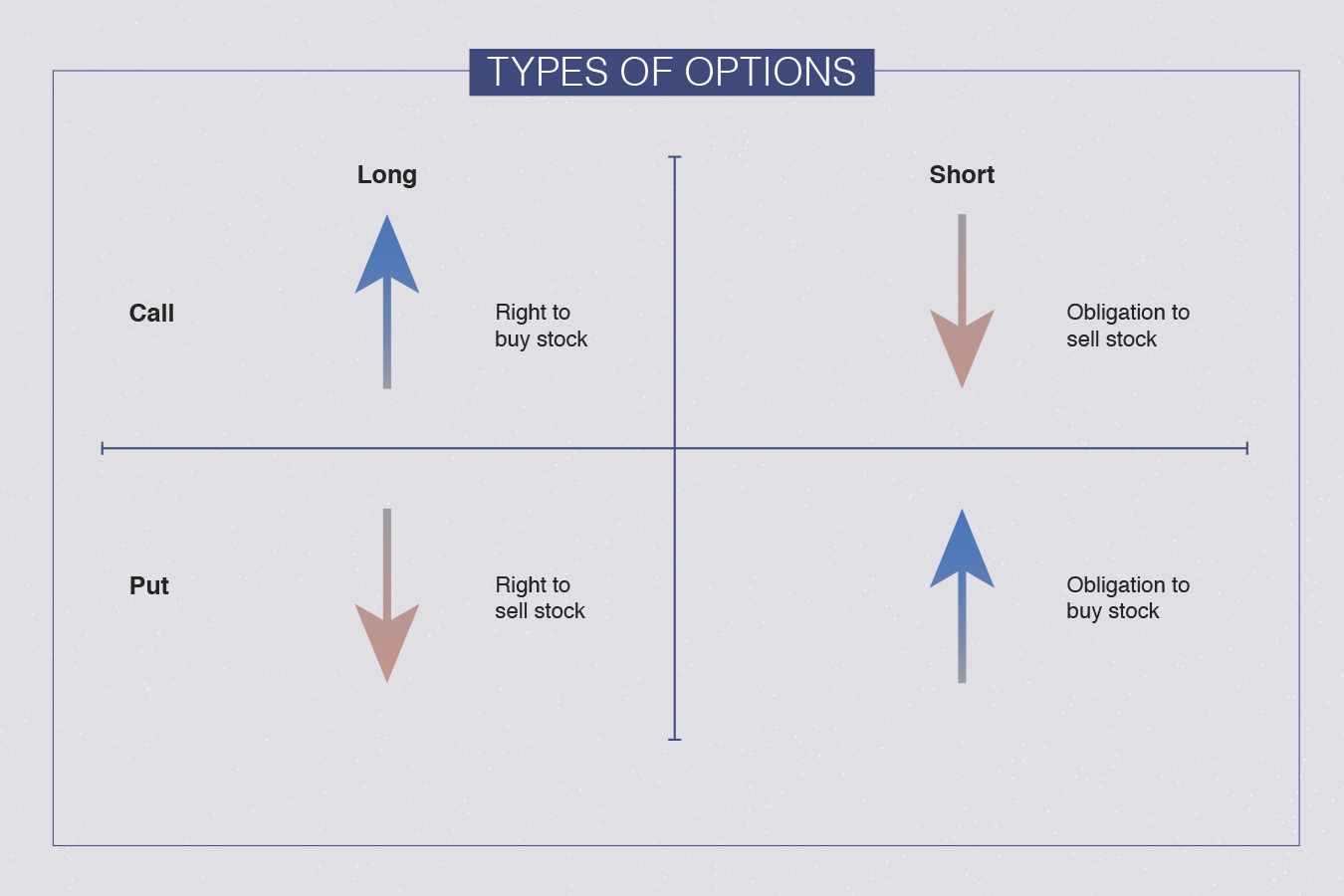

Evaluate and execute sophisticated trading strategies with ibkr. Understanding the market entries available in options trading provides a foundation to get started with options on futures. If you expect a big move in either direction, you can simultaneously buy a call and a put option with the same strike prices and expiration dates, profiting from.

Learn more & get started with opt. With this information, a trader would go into his or her brokerage account, select a security and go to an options chain. When buying a call option, the buyer must pay a premium to the seller or writer.

Ad with over 40 years' experience in options trading, we have a robust set of tools. We have the puts over here, and we have the calls on this side. Here i walk you throug.

Ad we’re all about helping you get more from your money. Join tony zhang, chief strategist of optionsplay & cnbc contributor of options action as we introduce the pros and cons of buying calls and puts. Dive into the four most commonly used strategies by options traders to get a deeper understanding of how it all.

And then under that, you have your calls and your puts also on the other side.

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

:max_bytes(150000):strip_icc()/BuyingPuts-4c4a647e895a41b8a828761e38465e1a.png)