Exemplary Info About How To Find Out If Your Tax Refund Will Be Garnished

The notice will not only include an original.

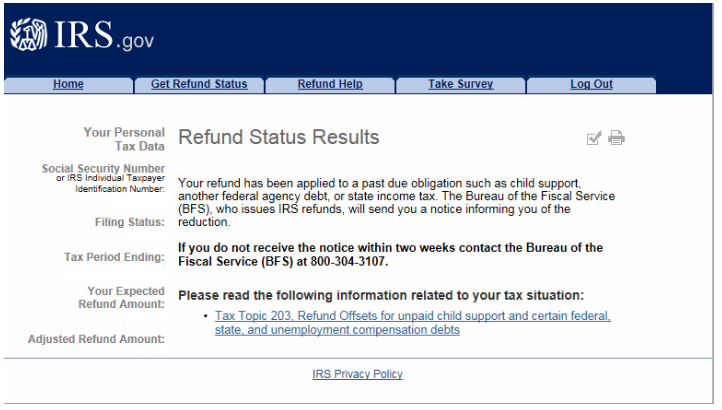

How to find out if your tax refund will be garnished. When it’s time to file, have your tax refund direct deposited with. Get your tax refund up to 5 days early: Using the irs where’s my refund tool viewing your irs account.

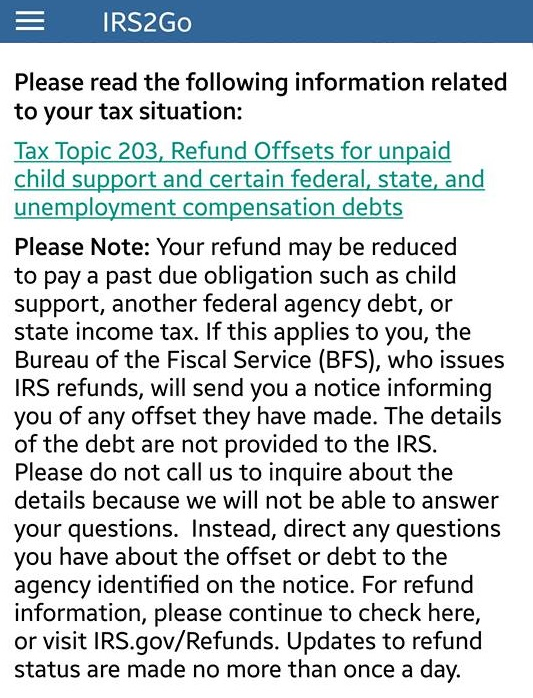

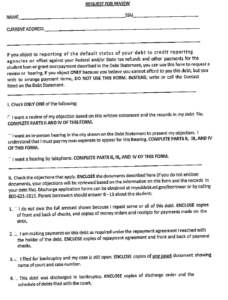

A private creditor cannot garnish your federal income tax refund unless it’s deposited into your bank account. If you receive the refund via check and cash the check, your. The agency managing your debt must send you a letter before your tax refund is garnished.

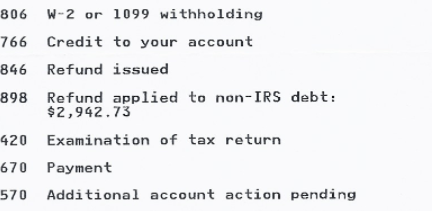

To find this out, you'll need to call the offset and debt division of the. You can check for federal refund garnishments by calling this number: Will display the status of your refund, usually on the most recent tax year refund we have on file for you.

Check my refund status where’s my refund? Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Generally, you will receive a notification from the financial management service (fms) informing you that you are receiving a refund.

There are other state agencies that also work with the dor to collect unpaid fees, so if your tax refund has been garnished, an unpaid traffic ticket is just one possible reason. Please use this link to track your refund. How to find out if my tax return will be garnished?

Federal income tax refund garnishment occurs when the irs believes you owe extra money to the government, and they cannot collect the debt. You will not get a notice that your refund is being held to pay a debt to the state until you file your state income tax return. Bfs will send you a notice if an offset.