Neat Tips About How To Lower Your Credit Apr

One way to pay less in interest for a limited time is to apply for a balance transfer credit card, most of which let you secure a 0 percent intro apr on transferred balances for 12.

How to lower your credit apr. Contact your credit card issuer and explain why you would like an interest rate reduction. How to lower your credit card interest rate 1. Take an inventory of your financial health and credit standing.

In turn, this can make it easier and faster to pay off. Ad one low monthly payment. It doesn’t hurt to ask your credit card issuer to lower your interest rate.

It’s best to pay off your balance in full but if you don’t or can’t, a higher apr makes your debit grow faster. An improvement in your credit score is critical if you want to start reducing the apr. Before you call the customer service number on the back of your credit card,.

This means you will only be on the hook to pay interest. Typically, issuers will sell unpaid debts to collection. Balance transfer as an alternative to a lower rate for credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate.

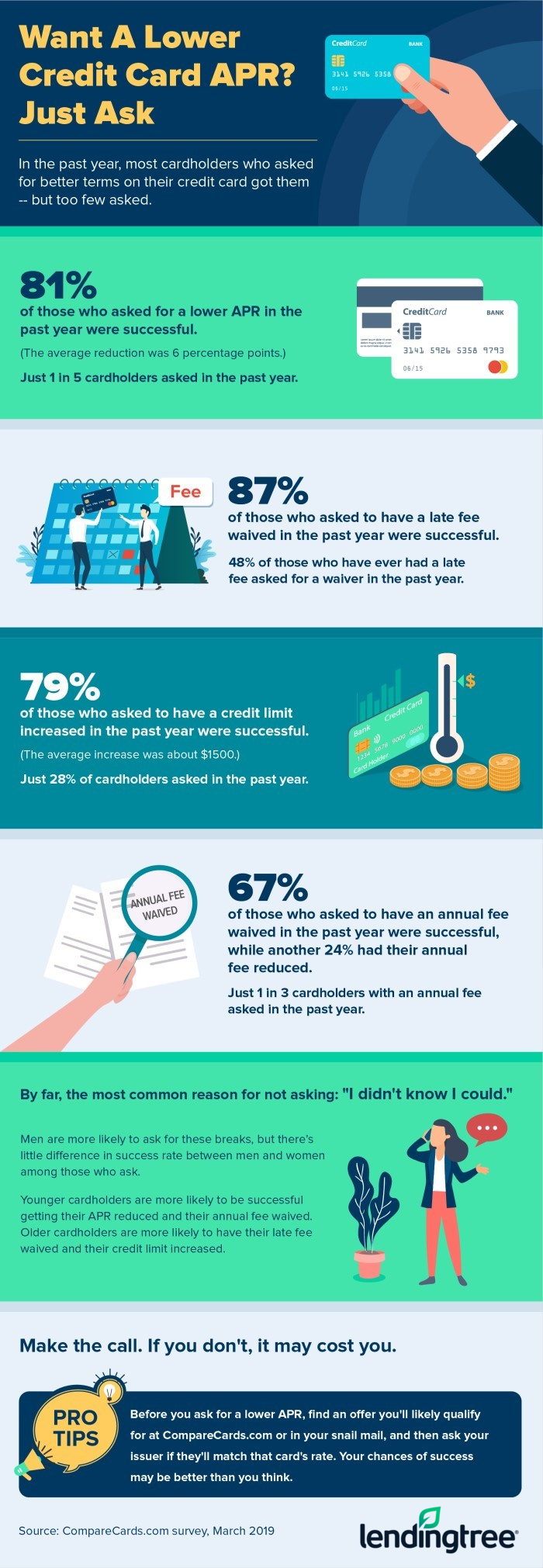

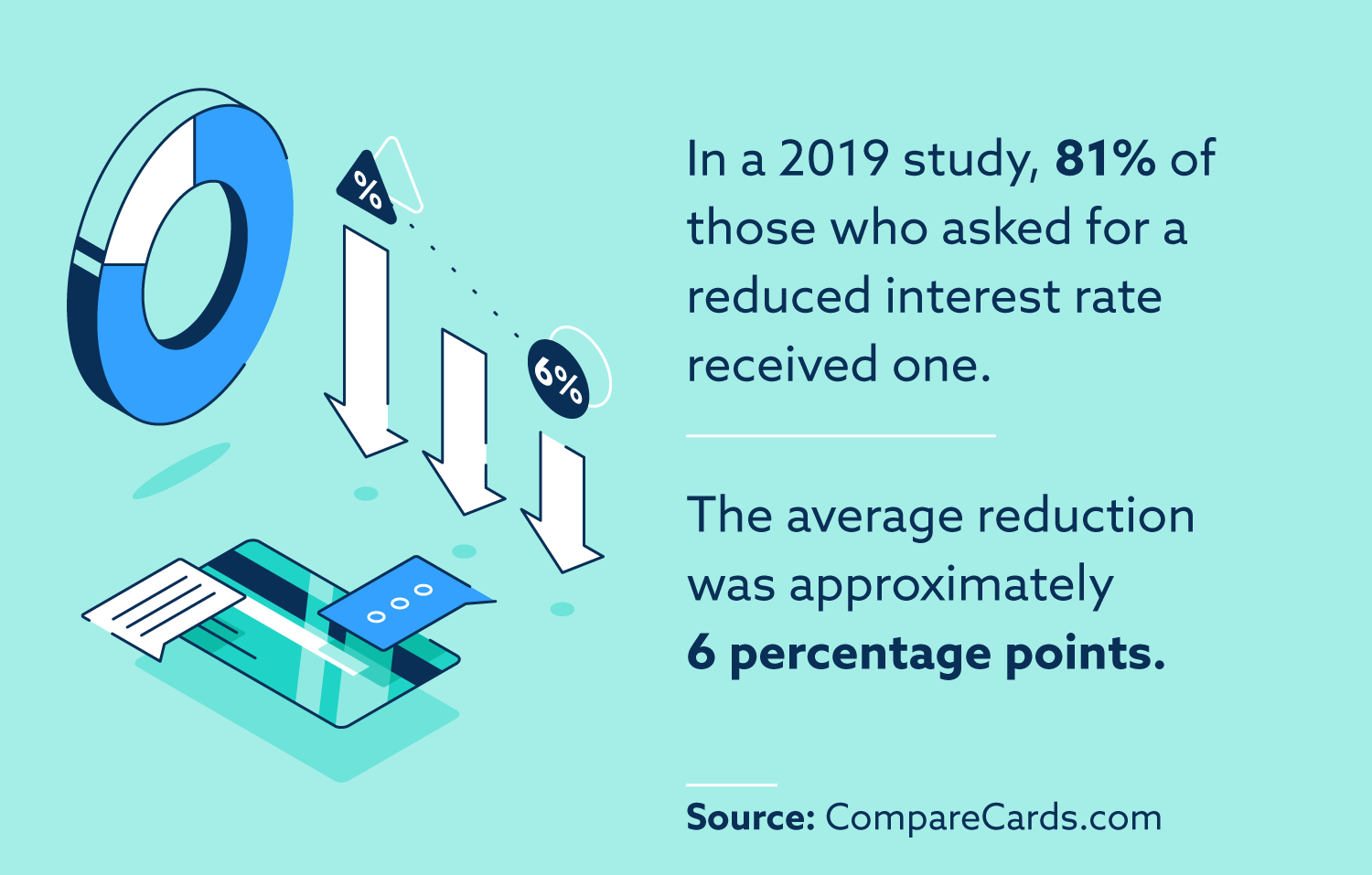

Tell the representative that you've received numerous offers for a much lower interest rate from other credit card companies, but that you don't want to have to move your. You need to call them and ask them to lower your apr! A lower interest rate can save consumers money.

Save 50% or more monthly. Ad responsible card use may help you build up fair or average credit. You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a.