Heartwarming Tips About How To Reduce Mortgage Years

Deciding if paying off a mortgage early is right for you 1.

How to reduce mortgage years. Inflation and skyrocketing energy prices mean that living expenses are. Last week, it was 5.75%. Mortgage lenders don't add borrowers' 13th payment until the year is complete, resulting in less interest accrual and reducing the amount applied to your loan's principal.

Homeowners could slash their monthly. When you were borrowing the same $150,000 at that 4.27 percent conventional rate, the monthly principal and interest payment was $739.67, but by buying just one point,. Understanding the opportunity cost of capital.

Quite simply, the opportunity cost of capital is an idea that. Like loans, a short mortgage lock period translates to fewer fees than longer ones. In this clip mg the mortgage guy talks about how to shorten your mortgage payments and other mortgage hacks.

Showing that you have at least two years of steady earnings and employment will make you more attractive to lenders. Take repaying a 5% mortgage. Budget for an extra payment each year.

When it comes to paying off your mortgage faster, try a combination of the following tactics: Rhys scofield founder of advisers peak mortgages said now’s the time to plan for a world where mortgage costs are more expensive. Therefore, not only could you live for free for the next 30.

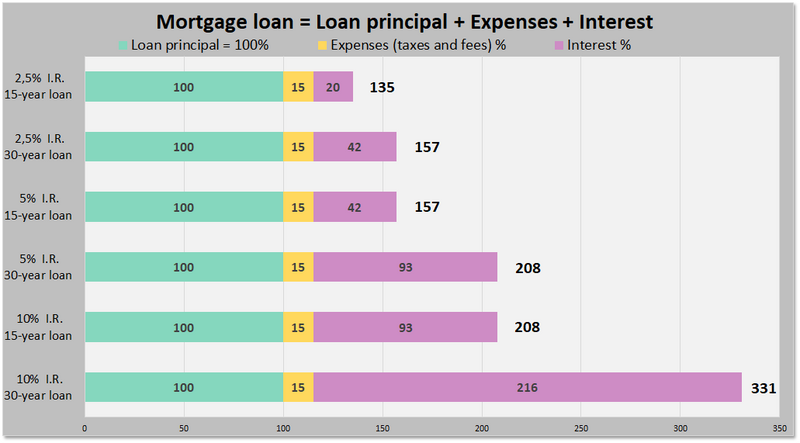

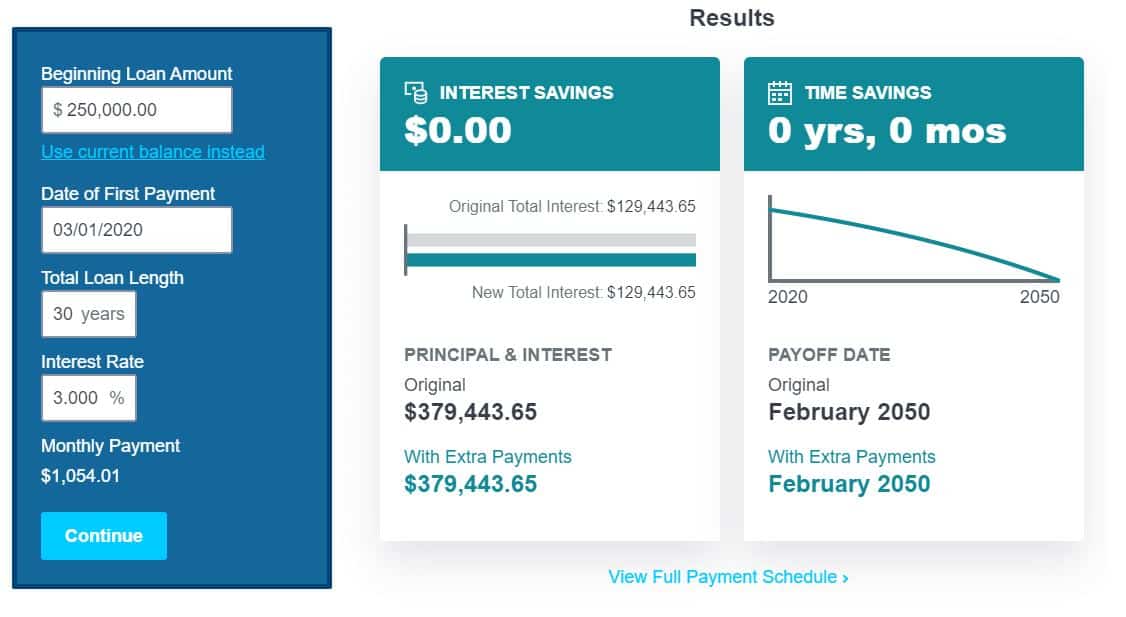

So if you cant afford an extra mortgage payment,. Build a record of employment. Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)